Carter Jonas Bradshaws looks at the impact of recent changes to Inheritance Tax

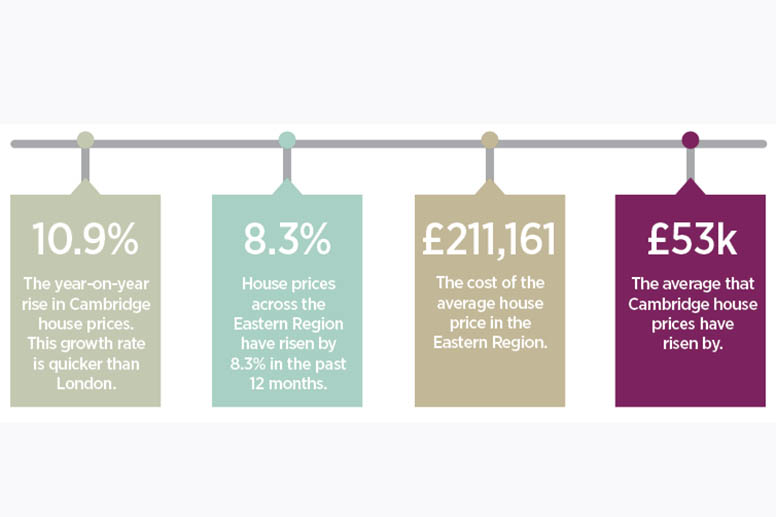

The ongoing rise in housing prices across the UK has led the number of properties worth upwards of £1 million to reach over 500,000 for the first time. Carter Jonas Bradshaws looks at how Cambridge has been affected, and what the recent changes to Inheritance Tax means for the ‘property millionaire.’ A recent report from Zoopla shows the number of ‘property millionaires’ in the UK has reached 524,306 – the biggest jump in 11 years. According to Hometrack, Cambridge is seeing a 10.9{b486c5a37ab2d325d17e17d701cb2567b1ecd1814e8ceb33effa2a4f1f171d46} year-on-year rise in house prices. This growth rate is quicker than London, which is showing a 9.4{b486c5a37ab2d325d17e17d701cb2567b1ecd1814e8ceb33effa2a4f1f171d46} increase.

Richard Hatch, partner of residential and sales at Carter Jonas Bradshaws, says: “Apart from being a great place to live, excellent schools, fantastic job prospects and an easy commute to London have helped drive the market in Cambridge. House prices across the Eastern Region have risen by 8.3{b486c5a37ab2d325d17e17d701cb2567b1ecd1814e8ceb33effa2a4f1f171d46} in the past year; the average is now £211,161. In Cambridge, average prices have risen by £53k, now at £348,300.

“It was inevitable we’d break the 500,000 barrier. We have offices in many hotspots – Bath, Winchester, Harrogate, York, Oxford, as well as 12 in London and four in Cambridge – so we’ve seen the growth first-hand.”

This rise appears to be proving profitable for current owners but is putting pressure on first-time buyers and home movers.

“Buyers need to be ready to move with funding in place,” continues Hatch. “A related sale often thwarts this, so many people looking to purchase will move into rented accommodation so they can move when the right opportunity arises, without delay.

“Sellers must put their property on the open market so they don’t miss highly motivated buyers prepared to pay over the odds. We often hear about private sales where the seller is proud of their off-market deal, though this decision can be regretted.”

The Budget 2015 refers to the increase in property value in the UK by including changes to Inheritance Tax (IHT). It states that by 2020 couples can leave assets worth up to £1 million without having to pay IHT.

“Some may say this large amount of tax-free cash only benefits the wealthy, but if you relate it to Cambridge property, you can see this isn’t the case. Carter Jonas Bradshaws recently sold a two-bedroom house for £650,000. If prices continue to rise at 10{b486c5a37ab2d325d17e17d701cb2567b1ecd1814e8ceb33effa2a4f1f171d46} to 2020, this house will be worth just shy of £1m. So this is not a relief on large opulent houses, these are family homes in the city.

“Others may argue that this encourages the older generation to sit on their large, high-value residences to mitigate IHT, thus slowing the flow of sales. However, anyone wanting to downsize will be eligible for an ‘inheritance tax credit’. So, even if they sell an expensive property, they will still qualify for the new threshold providing the bulk of the estate is left to direct descendants. This is an attempt to encourage pensioners to free up larger properties for growing families.”

www.carterjonas.co.uk/bradshaws